FSA vs. HRA: Understanding the Key Differences

When it comes to managing healthcare costs, flexible benefit accounts have become essential tools for both employers and employees. Two of the most common options are Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs). These accounts help offset out-of-pocket medical expenses while offering tax advantages.

Although both accounts serve a similar purpose, they work very differently. Understanding how each one functions can help employers choose the right option for their organization and employees.

What is an FSA (Flexible Spending Account)?

A Flexible Spending Account (FSA) allows employees to set aside pre-tax dollars from their paycheck to cover eligible healthcare expenses. These might include things like copays, prescriptions, dental and vision care, and certain medical supplies.

Here’s how it works:

Employees elect a contribution amount at the start of the plan year. This amount is also available on the first day of the plan year.

The funds are deducted from their paycheck before taxes are applied, reducing taxable income.

Employees can then use the funds to pay for qualified expenses throughout the year.

One key feature of an FSA is that it’s funded by the employee, not the employer (though some employers may choose to contribute). Because contributions are pre-tax, employees save money, and employers save on payroll taxes.

However, FSAs are subject to a “use-it-or-lose-it” rule, meaning unused funds typically expire at the end of the plan year. Employers may choose to offer a short grace period or allow a limited rollover (up to an amount set by the IRS), but any remaining balance beyond that is forfeited.

In short, FSAs offer:

Employee-funded savings for qualified medical expenses

Immediate access to the full annual election at the start of the year

Tax savings for both employees and employers

A deadline for using the funds

What is an HRA (Health Reimbursement Arrangement)?

A Health Reimbursement Arrangement (HRA) is a benefit account funded entirely by the employer to reimburse employees for eligible healthcare expenses. Unlike an FSA, employees do not contribute to an HRA.

Employers have full flexibility to design their HRA plan. They decide how much to contribute, and which expenses are eligible for reimbursement. Expenses can include out-of-pocket medical costs, dental or vision expenses, and sometimes health insurance premiums.

Key points about HRAs:

Funded 100% by the employer

Reimbursements are tax-free for employees and tax-deductible for employers

Unused funds may roll over at the employer’s discretion

Employers maintain ownership and control of the funds

HRAs offer more flexibility for employers and can be customized to meet organizational goals, whether that’s helping employees manage deductible costs, covering specific expenses, or supplementing other health benefits.

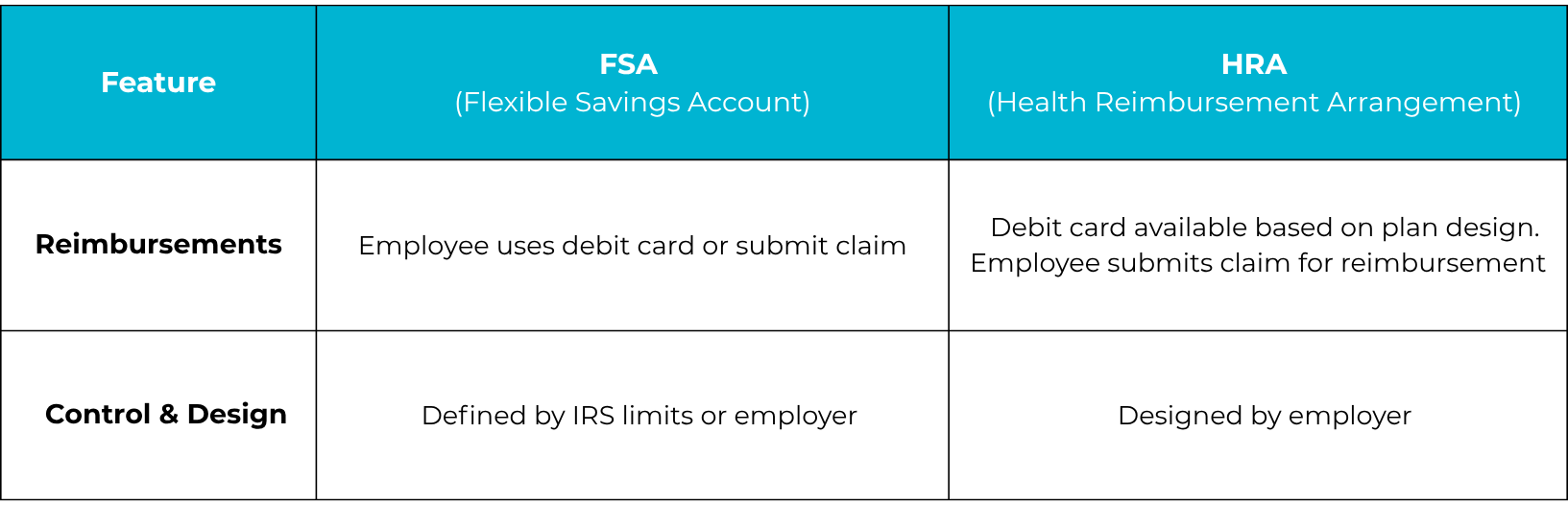

FSA vs. HRA: What’s the Difference?

While both FSAs and HRAs help employees pay for healthcare costs, they differ in several important ways:

The bottom line:

FSAs are ideal for employees who want to set aside their own pre-tax money for predictable healthcare expenses.

HRAs are ideal for employers who want to offer financial support for medical costs while controlling contribution levels and plan design.

Which Option Is Right for Your Business?

The best choice depends on your organization’s goals, budget, and the type of flexibility you want to offer employees.

Choose an FSA if:

You want employees to have the ability to set aside their own pre-tax funds.

You prefer a simple, employee-managed benefit.

Your workforce regularly incurs predictable medical expenses each year.

Choose an HRA if:

You want full control over how much to contribute and which expenses are reimbursable.

You’re looking to provide a benefit without requiring employee contributions.

You value the ability to tailor reimbursements based on your company’s needs.

Some employers even choose to offer both, allowing employees to contribute to an FSA while the company funds an HRA to cover larger or deductible-related expenses. This layered approach can maximize flexibility and provide a more comprehensive benefits experience.

How Helix Benefit Solutions Can Help

At Helix Benefit Solutions, we help employers simplify benefits administration with solutions designed to fit their team.

Through our Helix platform, employers can manage FSAs, HRAs, HSAs, and LSAs in one integrated system. Our approach streamlines benefit management, reduces administrative burden, and gives employees an easy way to access and track their funds.

When you partner with Helix, you get:

A dedicated account manager who understands your business

Simplified setup and administration of all spending accounts

Compliance support to ensure IRS and ERISA alignment

Seamless integration with payroll and other HR systems

Whether you’re looking to introduce new spending accounts or simplify your existing setup, we’ll help you create a benefits experience that works for everyone.

Ready to simplify your benefits administration?

Discover how Helix Benefit Solutions can help your organization manage FSAs, HRAs, and more, all in one place. Visit us at helixbenefits.net to learn more about our Benefits Administration Services or click here to contact us.